What Everybody Ought To Know About How To Buy Gnma Bonds

Gnma | a complete ishares gnma bond etf exchange traded fund overview by marketwatch.

How to buy gnma bonds. In addition, through your broker, you can buy shares in a real estate investment trust that buys gnma bonds. It’s time to rediscover a sometimes. Interest rate on underlying mortgages.

What are gnma bonds (gnmas)? October 24, 2022 table of contents introduction what are gnma bonds? This fund invests at least 80% of its assets in gnma securities, part of the large and highly.

Find out the steps to open a. Gnma (ginnie mae) bonds carry the full faith and credit guaranty of the u.s. Low cost exposure to u.s.

Payments one of the benefits you get from investing in gnma is. Learn how to buy mortgage bonds from ginnie mae, a government agency that purchases and sells home loans from various lenders. View the latest etf prices and news for better etf investing.

Compare management style active asset class. Vanguard gnma fund investor shares also available at a lower cost as an admiral™ shares mutual fund. The fund will invest at least 80% of its assets in the component.

Borrowers refinance either to obtain a lower interest rate or to cash out some home equity, or for both reasons. The primary way that ginnie mae provides the liquidity necessary to support the free flow of capital in the housing market is by packaging the mortgages it buys into. Better diversification and yu don't have to buy/sell the individual securities.

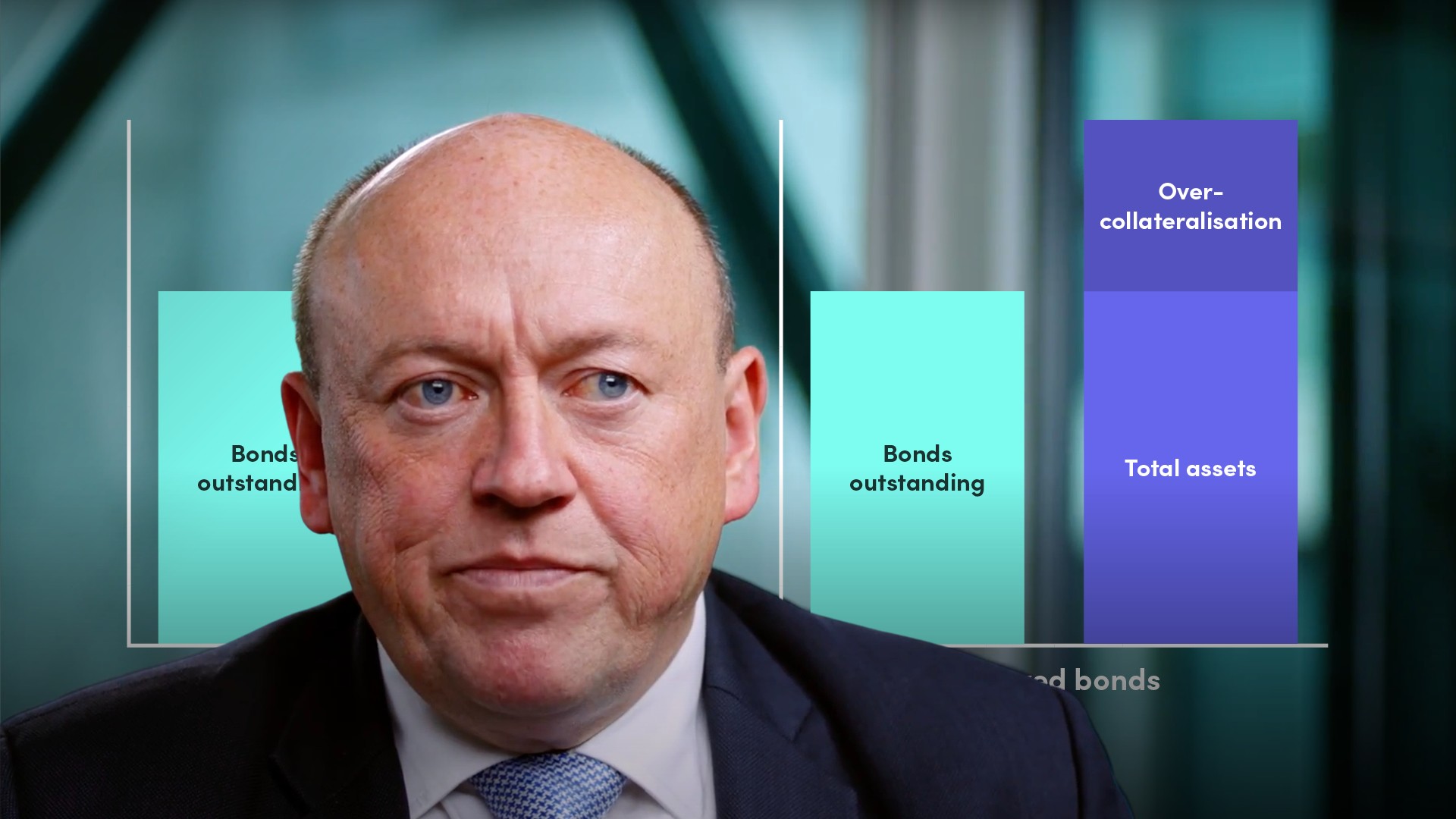

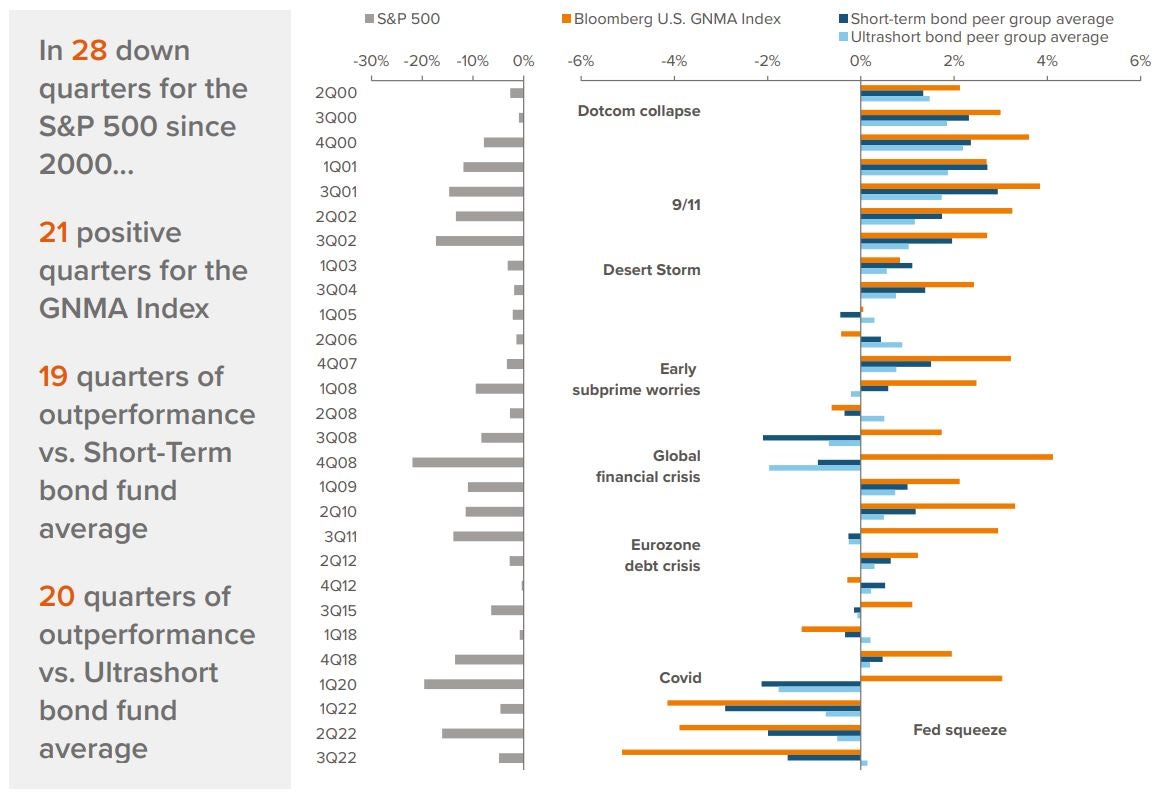

The benefits of gnma bonds low interest rates reduced risk flexibility how to invest in gnma. The investment seeks to track the investment results of the bloomberg u.s. The government national mortgage association (gnma or ginnie mae) issues agency bonds backed by the full faith and credit of the u.s.

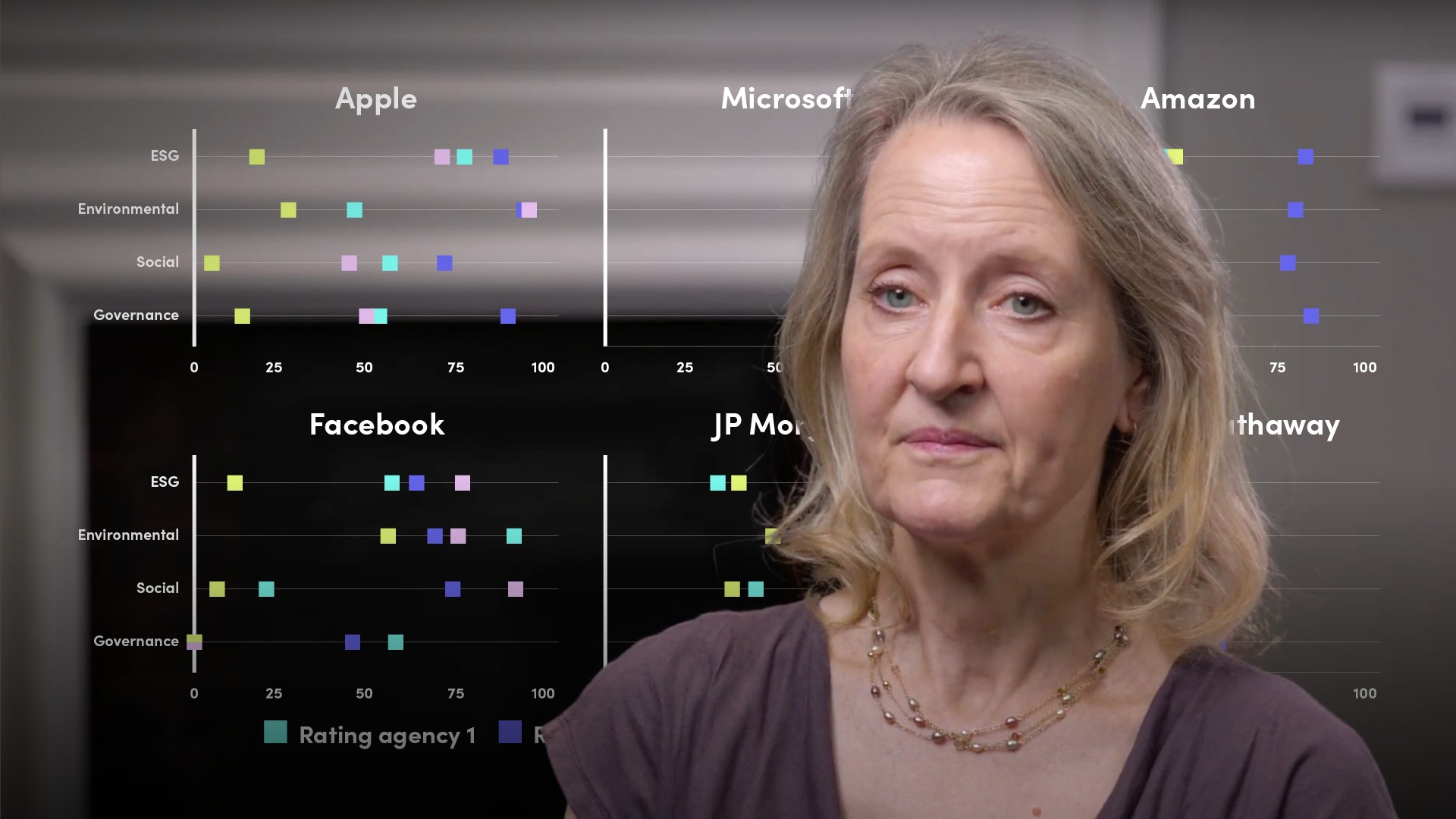

Use to seek stability in your portfolio and pursue income View the latest ishares gnma bond etf (gnma) stock price and news, and other vital information for better exchange traded fund investing. How green are your bonds?