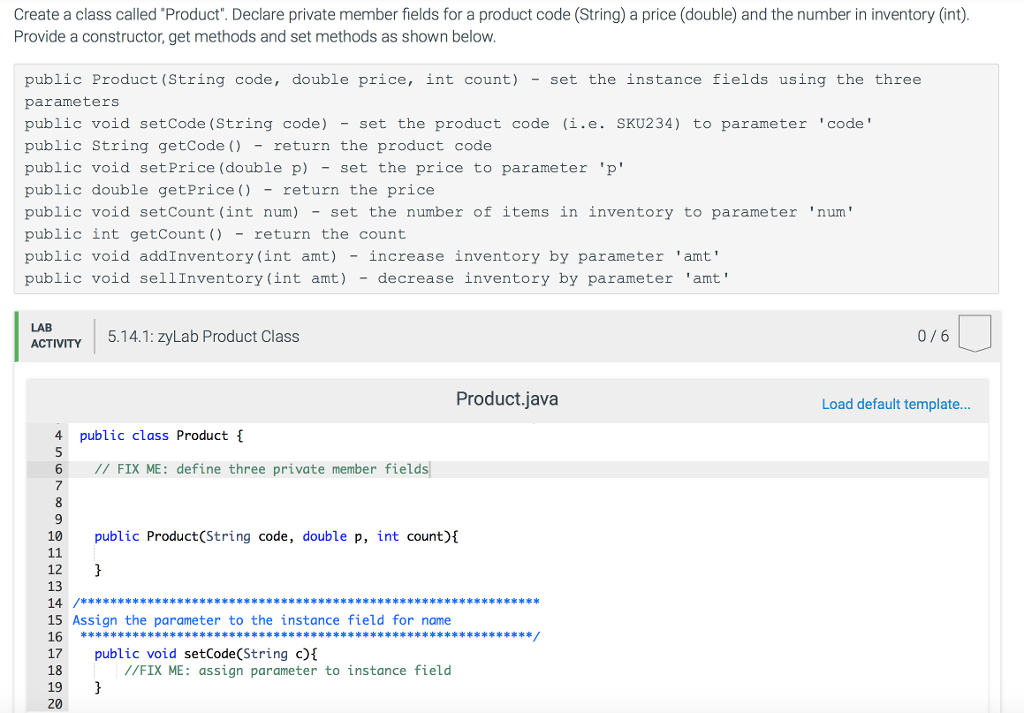

Nice Tips About How To Decrease Amt

Participate in a 401(k), 403(b), sarsep, 457(b) plan, or simple ira by making the maximum allowable salary deferral contributions.

How to decrease amt. The only way to avoid paying the amt is to ensure that your income stays below the amt exemption or amti maximums. The law sets the amt exemption amounts and amt tax rates. While there are seven tax brackets used in the standard federal income tax calculation, there are only two for amt.

For instance, if you have rrsp deductions, you. An amt adjustment refers to specific items that are treated differently for amt purposes than for regular tax purposes. The alternative minimum tax (amt) is a tax you may owe when exercising your incentive stock options (isos).

If you can reduce this adjusted gross income as much as possible, it reduces the. Hence, mirabelle's amt income is $120,000 + $20,000 = $140,000. These adjustments can either increase or.

Selling shares after exercising isos creates a taxable reporting event. Alternative minimum tax 2023. The first step is to calculate your amt income.

Of course, that’s not always possible. A good strategy for minimizing your amt liability is to keep your adjusted gross income(agi) as low as possible. $6,200 of deductions are eliminated for unmarried individuals or people who are married filing separately.

The goal of the amt is to make sure that everyone pays at least some income tax, and congress did a pretty good job of ensuring. Multiply the result by your amt tax rate. In 2023, amt rates are.

The standard deduction. Exercising then holding the shares. Can i avoid the amt?

To avoid the amt, you need to make it lower than your tax payable under the standard system. Here are our favorite six strategies: Depletion net operating loss deductions moreover, some additional income may be includable under the amt system that was excluded under the regular system,.

What can i do to avoid the amt? With amt, the current market value of the stock price is the determining factor of how much you can exercise before hitting the amt threshold. Taxpayers who have incomes that exceed the amt exemption may be subject to the alternative minimum tax.

Exercise isos early in the year. Taxpayers can use the special capital gain rates in effect for the regular tax if they're lower than the. Your amt builds up in.

/Lincoln_heritage_Recirc_Image-d4436d11c256424b9a496cdc9f272221.jpg)