Unique Info About How To Detect Money Laundering

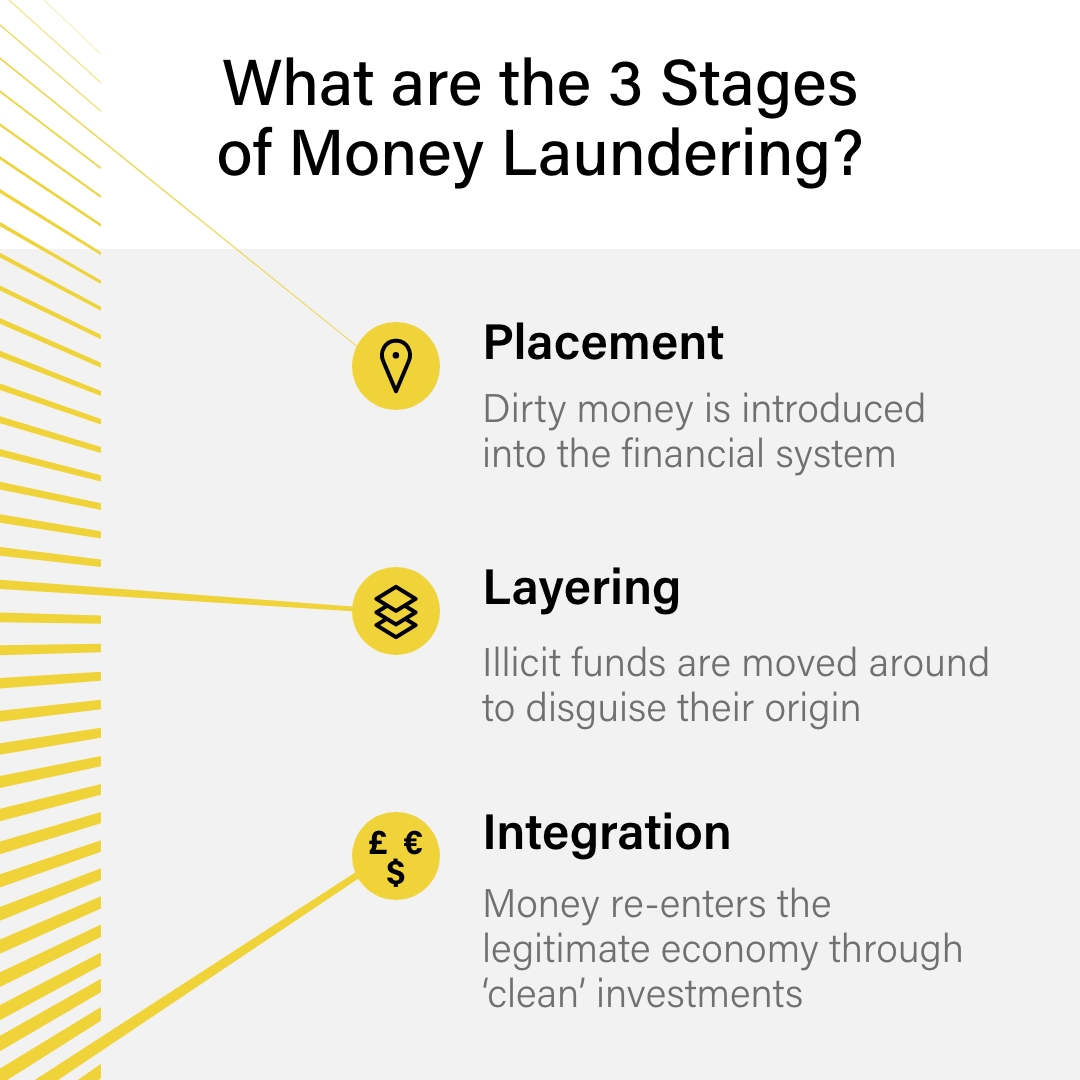

Placement surreptitiously injects the “dirty money” into the legitimate financial system.

How to detect money laundering. The $454 million judgment that a new york judge imposed on mr. But there are steps firms can take to upgrade transaction monitoring and to better detect and report suspicious activity. 23, 2024, at 2:42 p.m.

Some of the most common methods are smurfs, mules, and shells, which are outlined below. A money laundering watchdog removes the uae, uganda, barbados and gibraltar from a watchlist. A banker’s guide to avoiding problems (second edition june 1993).

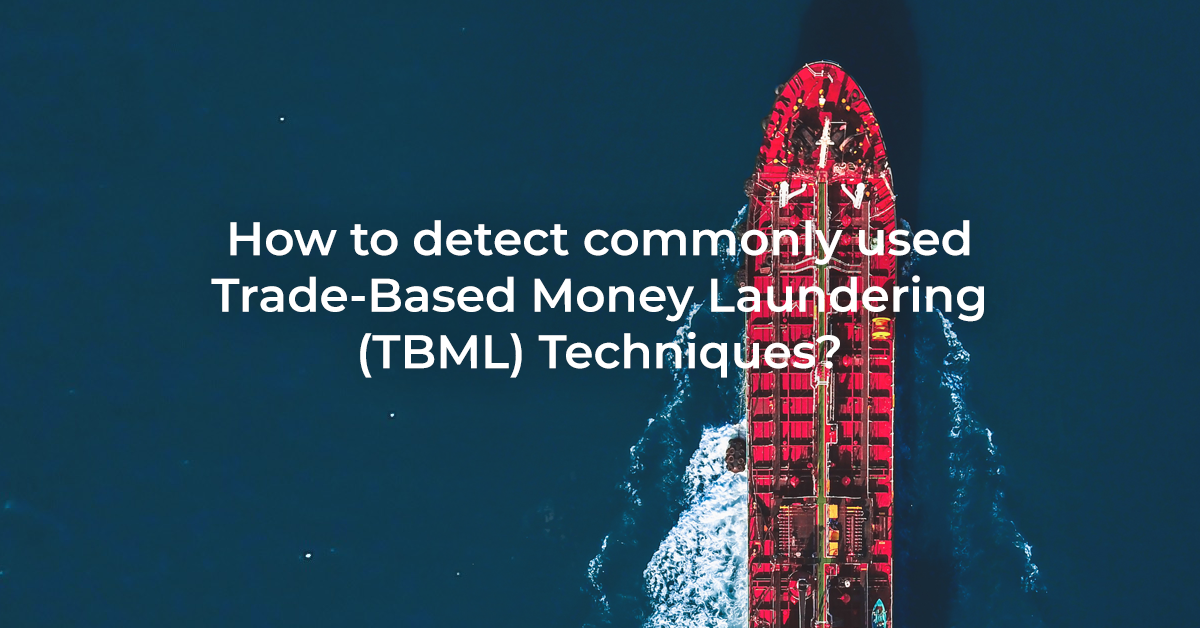

This study provides a number of case studies that illustrate how the international trade system has been exploited by criminal organisations. Prevent, detect, and investigate crime. Some other common examples of money laundering are:

Here are the top red flags to prevent money laundering, from the financial actions task force (fatf). Money laundering cases are hard to detect mainly because they are “decentralised”, said lawyer adam maniam, who was also on the show. Familiarize yourself with the tbml techniques below, including various forms of trade misinvoicing.

Plagued by inefficient data management, inadequate alerts about suspicious behavior and outdated technology, financial institutions are still facing an uphill battle in the fight against money laundering. This software screens transactions for suspicious activities and flags any that may indicate money laundering. Smurfs contrary to what you may believe, this doesn't have anything to do with the classic children's.

To effectively identify suspected money laundering and protect their organization from risk, financial institutions (fis) must know their customers, understand their behavior, and monitor for and detect suspicious activity patterns. Paris (ap) — an international watchdog said friday that it was. What tools can be used to detect money laundering?

In that way, financial criminals try to avoid detection by disguising their dirty money as legal profit. Below, we share some of the most common red flag indicators associated with money laundering. There are several tools that can be used to detect money laundering:

Methods used by fraudsters include: Now, he must either come. Id risk analytics analyze data to detect, prevent, and mitigate fraud.

Hong kong customs officials have arrested seven people linked to the territory’s largest ever money laundering case, involving about 14 billion hong kong dollars ($1.8 billion) some of it linked. Money laundering using credit cards is usually focused on executing payments that appear legitimate to conceal the illegal nature of the funds used. It is essential that your business is armed with the appropriate knowledge and resources when it comes to identifying suspicious activity, which may be an indicator of money laundering.

Examples of aml software include acams, sas aml, and. Money launderers use the latest techniques to evade detection. Lloyds said the investigation related to its compliance with money laundering rules in britain and the fca's rules and principles of business, with a focus on its controls framework.

:max_bytes(150000):strip_icc()/money-laudering-6cb10f0b844d460a99ab04b349da29ae.png)