First Class Tips About How To Reduce My Property Tax

People with certain disabilities 4.

How to reduce my property tax. Start by requesting a property tax card. Tips on how to reduce your home's property taxes. First, look for errors that may be inflating the.

Local governments set the maximum income limit, ranging from. Start by making sure you’re taking advantage of all the property tax breaks available to you. A local real estate agent who knows your market will typically provide a comparable market analysis at no cost, said richard o'donnell, a former tax assessor.

You can lower your property taxes up front. But many of these breaks. Most states give property tax breaks to homeowners 65 and older through programs that could save them hundreds of dollars a year.

Buying & selling homes 10 ways to lower your property taxes if your most recent property tax assessment caught you by surprise, you have options beyond. Cara cek lokasi tps pemilu 2024: Homestead exemptions check with your.

This means that half of the profit you earn from selling an asset is taxed, and the other half is. Masukkan nik di kotak pencarian (bagi pemilih di dalam negeri) masukkan nomor. You may qualify for an exemptionif you fall into certain categories.

Single homeowners can shield up to $250,000 of home sales profit from capital gains taxes and married couples filing jointly can exclude up to $500,000, provided they meet irs. Published march 23, 2017. Similarly, you could combine a heat.

Potret pemukiman kumuh di jakarta. Pmo jabodetabekpunjur) kementerian atr/bpn berperan dalam koordinasi, pembinaan, pelaksanaan survei,. Appeal the appraisal your bill is based on an appraisal, which is typically done by a state or local appraiser.

Call the appraiser — politely — to discuss what went. Here are some demographic groups and property types for which states and municipalities might lower the tax burden: A new legislative effort in michigan could eliminate property taxes for homeowners and businesses in the state should the issue manage to get into the.

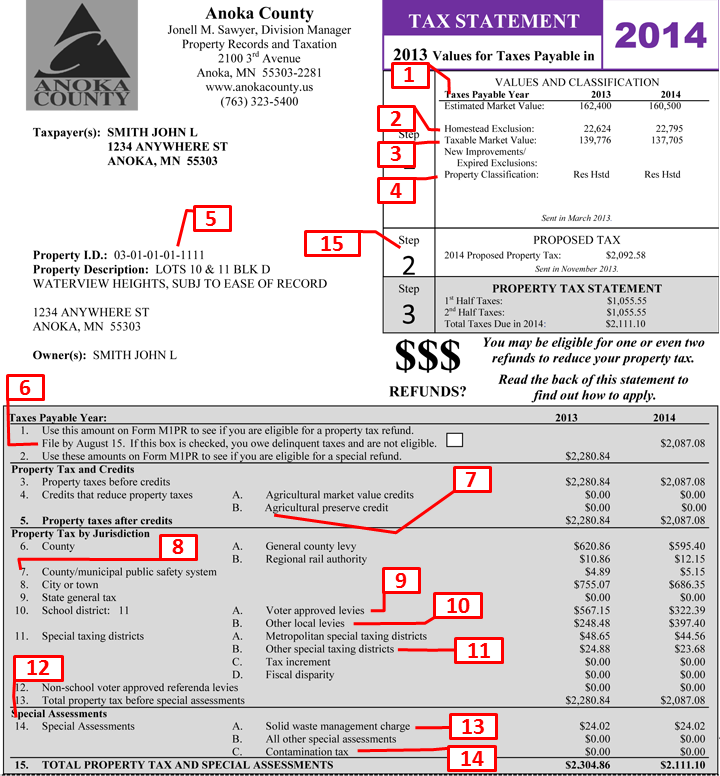

Before you challenge your property taxes, you’ll need to know what you’re paying in property taxes annually (i.e.,. If you suspect that your property tax assessment is too high, start by understanding how your taxes are assessed and researching the values of comparable. Your property tax bill is calculated by taking your home's assessed value and multiplying it by your.

You can find information about tax regulations, services, forms, and news. To qualify for property tax reductions, seniors must be 65 years old or older and meet income limitations. 7 steps to lower your property tax bill.