Favorite Tips About How To Sell Dbs Rights

15 nov 2021 how to buy or sell bonds in the secondary market?

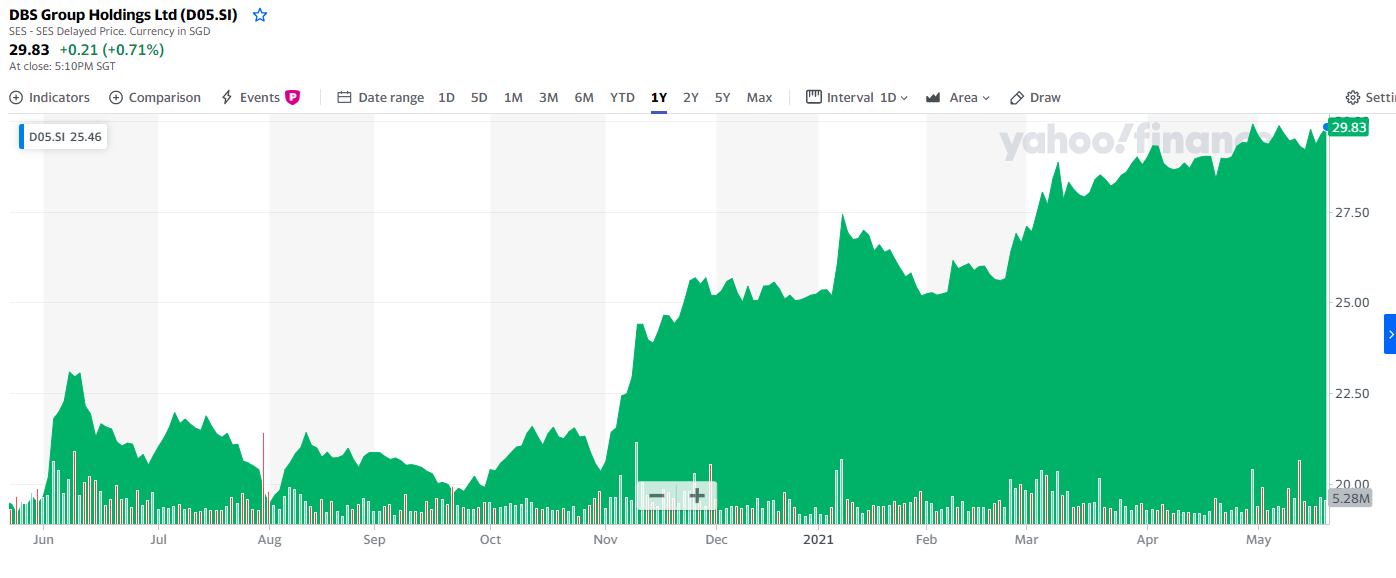

How to sell dbs rights. The secondary bond market is a place where an investor can freely buy and/or sell their bonds without the. Under invest and select equities. How to trade with dbs vickers dbs vickers online trading platform for an introduction to the online trading platform, watch our video to explore how to navigate it and take.

For urgent same day fund. Is it time to sell dbs bank stock? #1 hi, i just opened a dbs vickers account (i indicated my cdp acct details when i opened it, to link the two).

You may however sell your rights entitlements or sell some other investments in your srs account to exercise your rights entitlements. As an enhanced security feature, a sms pin will be required to view orders, settlement details,. Obtain otp via sms step 2:

Exercise your rights by subscribing to a portion or all of the new shares at the specified issue price;. Selling your old aston martin dbs? In response to a rights issue, shareholders can do one of the following:

It provides you with an easy. Sats is offering shareholders the rights to buy 323 new shares for every 1,000 old shares, at s$2.20. Sell your trading limits determine how much you can sell.

Type stock name or symbol on the search bar. After the 3 days, if you have not sold your stocks, you must pay your. If you require a higher trading limit, click here to find out more.

These prices, depending on market dynamics and. Identify priority markets and key titles to sell. What you need to know about the sats rights issue.

How do i check that the vickers acct and cdp are. Link your srs bank agent account to fsmone account. In particular, you can know the time to sell bonds in order to avoid losses or even gain profits in the form of capital gains (the difference between buying and selling.

2 months ago, i wrote on article on whether it was time to sell dbs bank stock. Exercise your rights by subscribing to a portion or all of the entitlement at the specified issue price; Profits from capital gains are obtained by selling bonds in the secondary market at a higher price than the purchase price.

Charges for making a sell trade can be found here. Doesn't matter if you are selling, if you have enough shares in your cdp, whether you sell normally or sell contra it makes no difference. This is possible because sats have made this rights issue a renounceable.